Indian Ferro Alloys vs. Global Market 2026: Performance & CBAM Impact

1. Executive Summary: The Strategic Shift in Global Metallurgy

The year 2026 has arrived with a distinctive set of challenges and opportunities for the global metallurgical sector. While the previous decade was defined by Chinese volume dominance, the current era is being shaped by three critical forces: Decarbonization (CBAM), Energy Security, and Supply Chain Diversification.

The ferro alloys industry—the "vitamins" of steelmaking—is at the epicenter of this shift. As of January 2026, the global ferro alloy market is witnessing a redistribution of power. South Africa, once the undisputed hegemon of Ferro Chrome (FeCr), is grappling with severe logistical and energy crises that have eroded its reliability. China, while still the volume leader, is constrained by domestic consumption caps and a slowing property market.

In this vacuum, India has emerged not just as a participant, but as a critical "Swing Producer." With domestic crude steel production rising by 6.8% in early 2025 (reaching ~144 MT annually) and a government target of 300 MT by 2030, Indian ferro alloy units are operating at higher utilization rates than their global peers. However, the road ahead is not without peril; the European Union’s Carbon Border Adjustment Mechanism (CBAM) has officially entered its payment phase as of January 1, 2026, threatening to reshape export economics.

This comprehensive analysis for LOHAA Blog delves deep into the comparative performance of Indian units, financial health of key players, regional production dynamics, and the strategic roadmap for 2026-2030.

______________

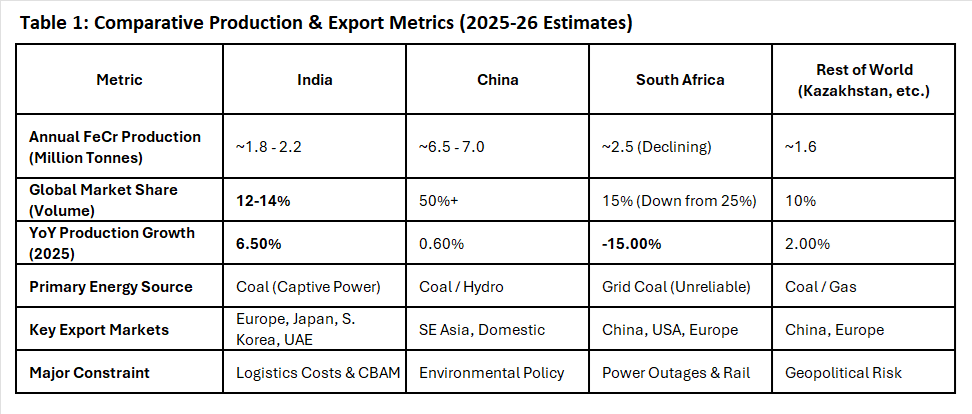

2. Global Performance Comparison: India vs. The World (2025-2026)

To evaluate India's standing, we must benchmark it against the traditional titans of the industry: China, South Africa, and the emerging players in Kazakhstan and Indonesia.

A. South Africa: The Giant Stumbles

South Africa holds nearly 70% of the world's chromite reserves, yet its dominance in ferro chrome production is fading.

• The Energy Crisis: The reliance on Eskom’s coal-based grid power has proven fatal. With electricity tariffs rising by double digits annually and load-shedding becoming chronic, smelters often operate at 60% capacity during winter months.

• Logistics Bottlenecks: The deterioration of Transnet’s rail network has forced miners to truck ore to ports, adding significant cost and delay. In November 2025 alone, South African ferro alloy exports dropped by nearly 47% YoY, creating a supply gap that India is actively filling.

• Strategic Pivot: South African miners are increasingly preferring to export raw Chrome Ore rather than beneficiated Ferro Chrome, inadvertently helping competitors like China and India who buy this ore to produce alloys.

B. China: The Constrained Behemoth

China remains the largest producer and consumer, but its role is changing from "Global Factory" to "Domestic Fortress."

• Production Caps: Strict environmental regulations in Inner Mongolia (the heart of ferro alloy production) have capped output. The days of unrestricted expansion are over.

• Cost Pressures: China is a high-cost producer of ferro chrome because it lacks high-grade domestic ore. It relies heavily on imports from South Africa and Zimbabwe. As ore prices rose by ~19% in 2024-25, Chinese margins have thinned to single digits.

• Export Decline: China’s focus has shifted to satisfying its own Electric Arc Furnace (EAF) steel production (430 MT capacity), leaving less surplus for export.

C. India: The Rising Alternative

India is capitalizing on these weaknesses.

• Capacity Utilization: Indian units, particularly those in Odisha and West Bengal, are reporting utilization rates of 80-85%, significantly higher than the global average of ~70%.

• Export Agility: India has become the leading net exporter of Silico Manganese to Europe and the Middle East, stepping in where Ukraine and Russia once dominated.

• The "Captive" Shield: The most successful Indian units are those with Captive Power Plants (CPPs). By generating their own power (often at ?3.5–?4.0/kWh vs. grid rates of ?7-9/kWh), they have insulated themselves from the energy inflation hitting South Africa and Europe.

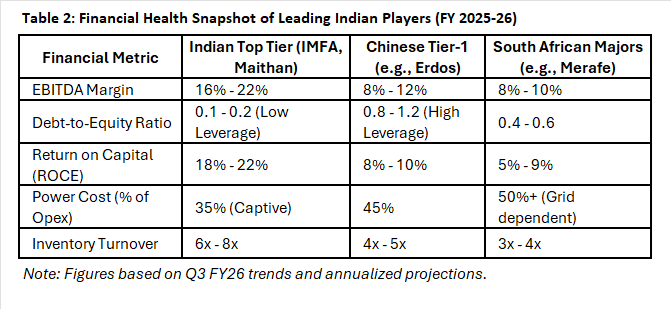

3. Financial Performance Analysis: The Balance Sheet Story

3. Financial Performance Analysis: The Balance Sheet Story

The true resilience of the Indian sector is visible in the financial health of its top players. Unlike the debt-fueled expansion seen in Southeast Asia, Indian companies have largely deleveraged over the last five years.

The "Integrated" vs. "Merchant" Divide

The Indian market is bifurcated. Integrated players (like IMFA) who own both mines and power plants are generating robust profits. Merchant manufacturers (who buy ore and power from the market) are facing margin compression due to volatile input costs.

Case Study: IMFA (Indian Metals & Ferro Alloys Ltd)

• Performance: In Q2 FY26, IMFA reported revenue growth of 10.69% QoQ.

• Margins: Consistently maintaining EBITDA margins of 19-22%, a rarity in the global commodities space.

• Strategy: They are the classic example of the "Odisha Advantage"—mines in Sukinda, power plant at the pithead. They have recently invested ?832 Million in a hybrid renewable energy project with JSW to mitigate future carbon taxes.

• Debt : Virtually net debt-free (0.16 D/E ratio), allowing them to weather cyclical downturns without distress.

Case Study: Maithan Alloys

• Performance: Known as the "lowest cost producer" of manganese alloys.

• Financial Health: While they faced a cyclical dip in late 2025 (reporting negative EBITDA in one quarter due to inventory write-downs), their balance sheet remains cash-rich.

• Strategy: They operate as a "conversion agent," focusing on extreme operational efficiency rather than mining. Their cash reserves are being deployed for expansion, betting on the long-term infrastructure boom.

4. The CBAM Challenge: The "Green" Wall of 2026

The most significant headwind for Indian ferro alloy units is the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transition to a payment-linked phase on January 1, 2026.

The Impact

Europe accounts for nearly 40% of India’s ferro alloy exports.

i) Quotas: The EU has imposed strict quotas. For 2026, India is limited to exporting roughly 126,800 tonnes of Silico Manganese to the EU. This is almost half of the potential export volume.

ii) Carbon Cost: Indian ferro alloys are produced largely using coal-based power. This results in a high carbon footprint (approx. 2.0 - 4.0 tonnes of CO2 per tonne of alloy).

iii) Pricing Pressure: With carbon taxes (approx €80/tonne CO2) factored in, Indian exporters might need to drop their FOB prices by 15-22% to remain competitive against "greener" alloys from Scandinavia or Brazil (hydro-based).

Market Reaction:

Exporters are scrambling. The "quota rush" is expected to cause chaotic shipping schedules in Q1 and Q2 2026, as companies race to fulfill orders before the quota limit is hit. Once the quota is breached, a prohibitive 25% duty kicks in.

______________

5. Comprehensive SWOT Analysis: India vs. The World

Strengths (Internal)

• Geological Endowment: India possesses 97% of its chromium resources in the Sukinda Valley (Odisha). This geological concentration allows for massive economies of scale in mining and transport.

• Captive Power Mastery: The integration of CPPs is India's "secret weapon." It stabilizes energy costs for 20-25 years, unlike competitors who are at the mercy of global gas/coal prices.

• Agile Manufacturing: Indian furnaces are versatile. Unlike the rigid, massive blast furnaces of China, Indian submerged arc furnaces can switch between Ferro Manganese and Silico Manganese depending on which offers a better premium (the "switch ratio").

Weaknesses (Internal)

• Inland Logistics: Transporting material from the hinterlands of Odisha/Chhattisgarh to the ports (Paradip/Vizag) is expensive. Rail freight in India is among the highest in the world (cross-subsidizing passenger travel), making internal movement 15-20% costlier than in China.

• Manganese Ore Dependency: While rich in Chrome, India is poor in high-grade Manganese. We rely on imports from South Africa, Gabon, and Australia. Geopolitical instability in these regions (e.g., Gabon coups) poses a supply risk.

• Technology Gap: Indian units lag in energy recovery. European units recover heat to generate electricity; most Indian units vent this heat, losing efficiency.

Opportunities (External)

• The "China Plus One" Shift: Global steelmakers (ArcelorMittal, Nippon Steel) are actively reducing reliance on Chinese supply chains. India is the only nation with the scale to be a viable alternative.

• Domestic Demand Floor: With the Indian government’s infrastructure push (PM Gati Shakti), domestic demand acts as a safety net. Even if exports slow due to CBAM, the local market needs massive quantities of alloy for TMT bars and rails.

• Green Premiums: There is a growing market for "Low Carbon Ferro Alloys." If Indian producers in the North East (using hydro) or Odisha (using solar hybrids) can certify their green credentials, they can bypass CBAM costs and command a premium.

Threats (External)

• CBAM & Protectionism: The spread of carbon taxes to the UK, Canada, and potentially Japan could isolate Indian coal-based producers.

• FTA Leaks: Free Trade Agreements with ASEAN nations often allow the "dumping" of cheap Indonesian or Vietnamese ferro alloys into India at zero duty, hurting domestic price realization.

• Coke Price Volatility: India imports most of its metallurgical coke. A spike in Australian coking coal prices directly impacts the bottom line.

______________

6. Indian Regional-Wise Production & Opportunities

The Indian ferro alloy landscape is not monolithic. It is a tale of three distinct regions.

A. Odisha: The Chrome Capital

• Production Hubs: Jajpur, Sukinda, Kalinganagar.

• Status: Produces >90% of India’s Ferro Chrome. Home to Tata Steel Mining, IMFA, Balasore Alloys.

• Opportunity: Value Addition. The region is saturated with basic HCFeCr production. The growth opportunity lies in setting up "Metal Recovery Plants" (recovering metal from slag) and producing refined Low-Carbon Ferro Chrome, which sells at 2x-3x the price of standard alloy.

• Investment Rating: High. (Best for integrated players).

B. Andhra Pradesh & Telangana: The Manganese Hub

• Production Hubs: Vizag, Bobbili, Garividi.

• Status: Historically the hub for Manganese alloys due to proximity to Vizag port (for imported ore).

• Challenge: Dependent on state grid power, which has become expensive. Many units have become "sick" or idle.

• Opportunity: Export & Consolidation. This region is best placed for exports to Southeast Asia (Vietnam, Thailand). There is a massive opportunity for larger players to acquire distressed assets here at bargain prices and turn them around with better working capital management.

• Investment Rating: Medium. (Requires deep pockets for turnaround).

C. The North-East & Bhutan Border: The "Green" Frontier

• Production Hubs: Meghalaya, Arunachal Pradesh, West Bengal border.

• Status: Hub for Ferro Silicon due to power availability.

• Opportunity: The CBAM Solution. This region has access to hydropower. Producing ferro alloys here results in a significantly lower carbon footprint.

• Strategic Play: Investors looking to export to Europe post-2026 should look exclusively at this region. "Green Ferro Silicon" from here will be exempt from high CBAM taxes.

• Investment Rating: High Growth. (Future-proof).

______________

7. Future Outlook: The Road to 2030

The "business as usual" model of buying coal, smelting ore, and selling generic alloy is effectively dead. The winners of the next decade will be defined by three pivots:

i) Renewable Integration: It is no longer optional. Companies like IMFA are already leading the way with solar-wind hybrids. Every ferro alloy unit must aim for at least 30% renewable energy in their mix by 2030 to remain export-competitive.

ii) Product Diversification: Moving up the value chain to Noble Alloys (Ferro Vanadium, Ferro Molybdenum). These are used in high-strength steel (defense, aerospace) and command stable prices, unlike the volatile bulk commodities.

iii) Backward Integration: For manganese alloy producers, securing equity stakes in mines in Africa (Gabon/South Africa) is crucial to hedge against ore price shocks.

Conclusion:

In 2026, the Indian ferro alloy industry stands at a crossroads. It is performing exceptionally well financially compared to a struggling world, driven by domestic strength and astute management. However, the "Green Wall" of global trade is closing in. The transition from a "Low Cost Producer" to a "Low Carbon Producer" is the only path to global dominance. For stakeholders and investors, the Indian market offers a rare combination of value (undervalued stocks), growth (infrastructure boom), and resilience.

______________

References

1. Ministry of Steel, Govt of India (2025). Annual Report 2024-25: Steel & Ferro Alloy Sector Performance. (Retrieved from steel.gov.in).

2. IMARC Group (2025). India Ferroalloy Market Trends & Growth Forecast 2025-2033.

3. Fastmarkets (Jan 2026). Global Ferro-Chrome Supply Chain Shifts: The Decline of South African Output.

4. Argus Media (Dec 2025). Viewpoint: EU curbs and CBAM impact on India's Manganese Alloy Outlook 2026.

5. Global Trade Research Initiative (GTRI) (2025). Report on CBAM Impact on Indian Metal Exports.

6. IMFA & Maithan Alloys. Quarterly Financial Reports (Q2/Q3 FY26) and Investor Presentations.

7. Indian Bureau of Mines. Mineral Production Estimates 2024-25.

8. Joint Plant Committee (JPC). Trend Report: Indian Steel Industry April-December 2025.