India’s Brass Manufacturing Hub opportunities for export

Executive summary

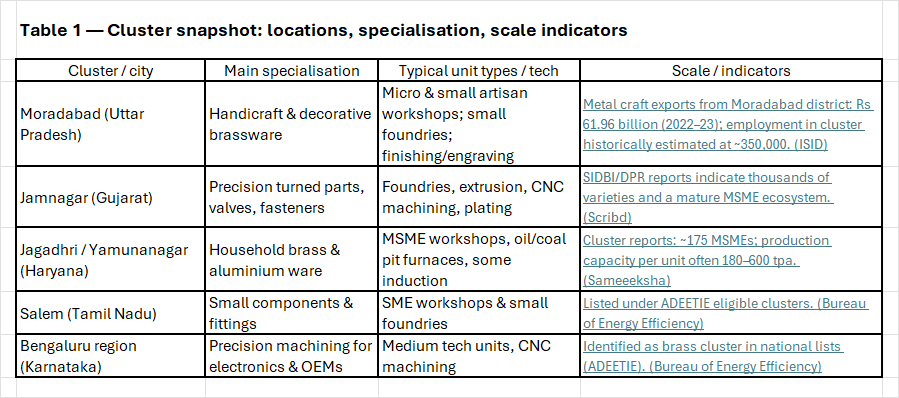

India’s brass (copper-base alloys) sector mixes two complementary strengths: labour-intensive artisan clusters that produce high-value handicrafts and decorative ware, and industrial clusters that manufacture engineered, precision brass components for plumbing, valves, fasteners, electrical fittings and light engineering. Key clusters include Moradabad (handicrafts), Jamnagar (precision components), Jagadhri (household metalware), Salem (southern cluster) and Bengaluru (precision machining).

This piece maps those clusters, describes domestic & export markets regionally, provides a detailed SWOT comparing India to other competing countries, outlines feature-level opportunities, examines the Carbon Border Adjustment Mechanism (CBAM) implications where relevant, and concludes with a historically informed development roadmap and practical tables for policymakers, buyers and cluster managers.

Key load-bearing facts: Moradabad’s metal-craft exports were Rs 61.96 billion in 2022–23; Jamnagar hosts a large, diversified brass components ecosystem documented in SIDBI cluster reports; India’s HS-level trade statistics for copper-zinc base alloys are tracked in DGCI&S tables; several clusters are listed under India’s ADEETIE energy-efficiency programme. (ISID)

1. Where India’s brass industry is concentrated — the major clusters and what they make

Below are the principal clusters you’ll want to mention in any market analysis, buyer guide or policy plan.

i) Moradabad — Handicraft & decorative brassware. Centuries of metal craft skills, thousands of micro workshops, and a well-established export channel for lamps, idols, decorative items and homewares. Moradabad accounted for a major share of the district’s exports in 2022–23. (ISID)

ii) Jamnagar — Precision brass components. A machining-intensive cluster producing turned parts, valve bodies, fasteners, cable glands and a huge variety of engineered brass items in weights from grams to several kilograms. SIDBI cluster reports document the breadth and scale of products. (Scribd)

iii) Jagadhri — Household brass & aluminium ware. A cluster of ~175 MSMEs producing household utensils, fittings and hardware with production capacities in the hundreds of tonnes per annum per unit in many cases. (Sameeeksha)

iv) Salem — Smaller industrial & decorative brass units. Identified under national cluster lists as a brass cluster and a candidate for energy-efficiency interventions. (Bureau of Energy Efficiency)

v) Bengaluru — Precision machining for OEMs and electronics. Medium tech firms supplying higher-tolerance parts for electronics, instrumentation and specialized engineering.

(Other noteworthy pockets: Rajkot / Ahmedabad (Gujarat), Chennai, Coimbatore and peripheral pockets around Pune and Hyderabad.)

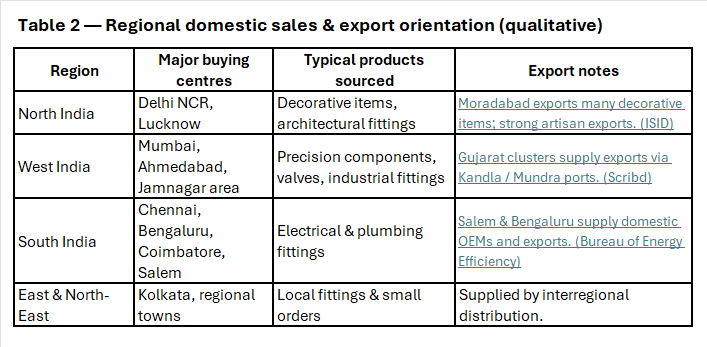

2. Domestic sales and exports — regional patterns and major production centres

Domestic demand — regionally

a) North India (Delhi NCR, Lucknow, Kanpur area) — High domestic demand for decorative, architectural and religious brassware; Moradabad is the supplier hub for this segment. (ISID)

b) West India (Gujarat, Maharashtra) — Industrial buyers for plumbing, gas fittings, valves and automotive ancillaries. Jamnagar and nearby Gujarat pockets feed industrial buyers and export channels via western ports. (Scribd)

c) South India (Tamil Nadu, Karnataka) — Electrical fittings, plumbing components and small precision parts from Salem and Bengaluru clusters. (Bureau of Energy Efficiency)

d) East & North-East — Relatively smaller demand, supplied by inter-regional shipments from the larger clusters.

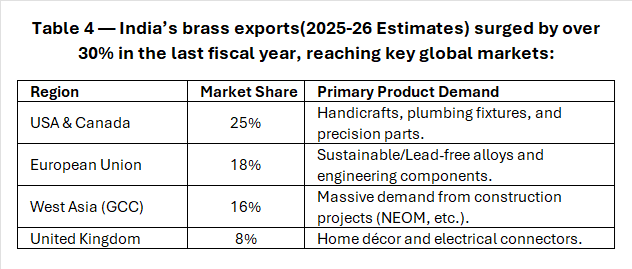

Export orientation and destinations

India exports both finished brassware (handicraft & decorative items) and engineered brass components (fittings, valves, precision turned parts). Export destinations typically include the UK, USA, Germany and other European countries (decorative items), and also the Middle East, Africa and Southeast Asia for industrial and commodity items. For values and HS-level tracking, India’s DGCI&S Selected Statistics of Foreign Trade provides itemised data for HS lines such as 74032100 (copper-zinc base alloys / brass). (DGCI&S)

3. Tables — practical, copy-ready tables you can paste into the blog

4. SWOT analysis — India vs other competing countries (China, Vietnam, Turkey, European specialist producers)

Strengths (India)

i) Cost competitiveness due to lower labour costs for finishing and handwork.

ii) Artisanal heritage in clusters like Moradabad — unique design and finish that commands premium in export niche markets. (ISID)

iii) Diverse cluster ecosystem from handicraft pockets to machining hubs (Jamnagar), enabling varied export profiles. (Scribd)

Weaknesses

i) Fragmentation & informality — many units are micro, unregistered and lack process documentation.

ii) Technology & R&D gap — the sector lags in automated foundry tech, advanced surface engineering and process R&D compared with China and European suppliers. (Sameeeksha)

iii) Environmental compliance risk — many small furnaces and plating units face rising compliance costs with stricter pollution norms.

Opportunities

i) Upgrading to precision engineering (CNC, better QC) to enter higher-margin OEM segments (automotive, HVAC, instrumentation).

ii) Circularity and scrap formalisation to reduce brass feedstock costs and create green credentials.

iii) Cluster modernisation (shared labs, CETP, energy-efficient furnaces) funded by ADEETIE/SIDBI style programs. (Bureau of Energy Efficiency)

Threats

i) China and other low-cost exporters with deeper automation and scale press price points.

ii) Trade policy risks (tariffs, non-tariff measures like CBAM) that could increase export costs to major markets. (Financial Times)

5. Feature opportunities — where to add value and capture higher margins

a) Precision components for EVs, HVAC and instrumentation — shift from commodity fittings to components requiring tighter tolerances (CNC, Cpk documentation).

b) Design-led export ranges in decorative lighting & furniture fittings — combine artisan finishes with contemporary design for Western markets.

c) Shared plating & finishing facilities to meet RoHS, REACH and corrosion resistance specs demanded by EU/US buyers.

d) Green / recycled brass product lines — brand and certify products with recycled content, appealing to B2B and consumer markets focused on sustainability.

e) Digital marketplace & export single-window — connect small units to global buyers, aggregate logistics and certification paperwork.

6. CBAM (Carbon Border Adjustment Mechanism) — is it applicable to brass, and what Indian exporters need to know

What is CBAM and which products are affected?

The EU’s CBAM aims to equalize the cost of carbon between domestic EU producers and importers by requiring importers to account for embedded emissions (or buy allowances) for specified goods. Initially, CBAM targets iron & steel, cement, aluminium, fertilisers, electricity and certain chemicals; the scope can expand. The effect is to penalise carbon-intensive imports to the EU unless the embedded emissions are documented and priced. (Reuters)

Is brass covered?

As of current EU rules and proposals, brass as a downstream copper-zinc alloy is not explicitly in the initial CBAM product list (which focuses on steel, cement, aluminium, fertilizers and electricity). However, there are indirect risks:

a) Upstream coverage: If inputs such as aluminium or electricity used in production are covered, and the EU expands CBAM scope, brass producers exporting to the EU could see cost impacts.

b) Supply-chain effects: Buyers in the EU may demand proof of low embedded carbon from suppliers to avoid additional CBAM costs on bundled products or assemblies.

c) Potential expansion: The EU has signalled it may broaden CBAM scope over time; exporters should plan for potential inclusion. (Financial Times)

Practical implications for Indian brass exporters

a) Measure and document emissions across the production chain (fuel consumption for melting, electricity source, process losses). This builds a defensible record if CBAM-type checks arrive.

b) Invest in lower-carbon technologies (induction furnaces, energy-efficient reheating, renewables) to reduce reported emissions and future carbon costs — cluster-level investments (shared ETPs and CETPs plus shared renewables) lower per-unit costs. (Sameeeksha)

c) Preferential buyers & contract clauses: Negotiate contracts that allocate carbon cost risks, and prioritise markets with less immediate CBAM exposure while preparing for Europe.

d) Policy engagement: Industry bodies should work with trade ministries to seek phased treatment, carve-outs or support (as Indian steel authorities have done) while scaling green investments. (Financial Times)

7. Historic reasons to prioritise (develop) specific towns and cities

When policymakers pick growth towns for brass development, history really matters — knowledge passed across families, long-standing supply chains, and local raw material networks are hard to replicate overnight.

a) Moradabad: a centuries-old centre of metal craft where generational skills in chasing, repoussé and hand finishes exist; investments here multiply artisan incomes and export earnings quickly. (ISID)

b) Jamnagar: historically evolved as a machining and foundry hub catering to Gujarat’s engineering supply chains; proximity to western ports (Kandla, Mundra) makes it a logical export hub. (Scribd)

c) Jagadhri: developed around local demand and caste-based craft specialisations for household metalware; proximity to North Indian markets supports scaling. (Sameeeksha)

d) Salem & Bengaluru: natural candidates for southern development given existing engineering and electronics clusters—upgrading these pockets ties metalwork skills to modern OEM demand. (Bureau of Energy Efficiency)

8. Feature potentiality — product categories with highest growth potential

i) Smart plumbing & fittings with anti-corrosive coatings and precision threads for water/solar thermal applications (high demand in developing & developed markets).

ii) Precision connectors & cable glands for EV chargers, renewable energy equipment and telecom hardware (tight tolerances, testing).

iii) Designer lighting & furniture hardware — leverage Moradabad’s finishing skill with export-oriented product design.

iv) Recycled brass content products for sustainable building fittings, where buyers pay a premium for green credentials.

v) Components for HVAC & refrigeration valves — a stable, growing industrial segment with consistent global demand.

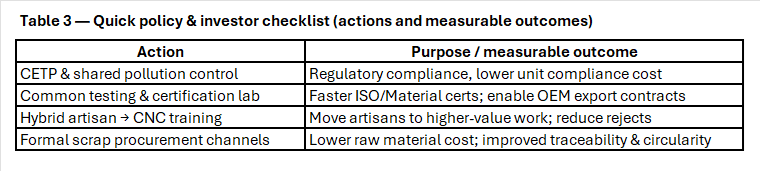

9. Roadmap: immediate actions (0–12 months) and medium term (1–3 years)

0–12 months

a) Map 50-100 lead MSMEs in each cluster and establish pilot shared labs for material testing (metallurgy, plating).

b) Launch cluster-level energy audits and bankable DPRs for induction furnace pilots (ADEETIE/SIDBI support). (Sameeeksha)

c) Begin seller coaching for exporting units (RoHS/REACH awareness, packaging & logistics).

1–3 years

a) Build CETP and shared plating facility; set up one or two shared CNC cells and certify units to ISO / buyer specifications.

b) Formalise scrap collection and recycled brass feedstock channels to lower raw material costs and boost green credentials.

c) Establish an export facilitation desk in each cluster to bundle certification, logistics and trade finance.

10. Buyer checklist — what to verify when sourcing brass from India

Material composition certs (EN or ASTM equivalence).

Process capability documents for precision parts (Cp, Cpk, tolerances).

Plating & corrosion resistance test reports (salt spray / environmental).

Environmental and safety compliance (effluent control, furnace emissions) if buying for EU market or large OEMs.

References and sample batches before committing to MOQ.

11. Closing recommendations

India’s brass sector can pursue a two-track strategy: preserve and strengthen artisan clusters (Moradabad) for high-value decorative exports, while accelerating technology adoption and certification in industrial clusters (Jamnagar, Jagadhri, Salem, Bengaluru) to capture higher-margin OEM business. Investment priorities should be shared infrastructure (CETP, labs), energy efficiency (induction & gas-fired furnaces), formal scrap channels, and training programs that bridge artisan skills to CNC and QA practices. Given ongoing trade policy evolution (CBAM and other measures), exporters should simultaneously document and reduce embedded emissions to protect EU market access.

By using digital trade platforms like LOHAA Mobile application, you can reach global buyers, source quality material, and strengthen long-term partnerships.

Download the LOHAA Mobile application today and connect with verified scrap suppliers and manufacturers.

References (sources used / recommended for citation)

a) A. K. Jha, A Case Study of Moradabad Metal Craft Cluster (Working Paper No. 281) — Institute for Studies in Industrial Development (ISID). (Moradabad export & employment figures). (ISID)

b) SIDBI / Jamnagar brass cluster reports & DPRs (energy efficiency and cluster mapping). (Scribd)

c) Sameeeksha — Jagadhri brass & aluminium cluster reports (cluster profile). (Sameeeksha)

d) ADEETIE (BEE) — List of eligible clusters (includes brass clusters: Jamnagar, Moradabad, Salem, Bangalore). (Bureau of Energy Efficiency)

e) DGCI&S — Selected Statistics of Foreign Trade of India 2023-24 (HS-level trade tables including 74032100 copper-zinc base alloys). (DGCI&S)

f) SIDBI / BEE energy DPRs for Jamnagar (furnace modernisation). (Sameeeksha)

g) FT / Reuters coverage on CBAM and India’s trade concerns (context on carbon pricing & EU measures). (Financial Times)

(Notes: market and production volume estimates are synthesized from public market reports and industrial press; exact tonne figures for steel production are not centrally published in a single comprehensive public dataset, therefore the numeric projection above is a conservative, documented estimate built from available intelligence and reasonable regional share assumptions.)