2026 Global Super Alloy Market: Export potential for India

Executive summary

India sits at a strategic inflection point to expand exports of superalloys — especially nickel- and cobalt-based alloys used by aerospace, power-generation (gas turbines), specialty chemical and defence sectors. Global demand for superalloys is growing as aerospace production recovers, energy-sector turbines age out, and advanced manufacturing (AM/3D printing) adopts high-performance feedstock. At the same time, volatile primary metal markets and tightening regulatory controls on scrap flows (e.g., evolving EU export policy) are reshaping raw-material sourcing and recycling strategies. This creates an immediate opening for India to scale alloy production by combining domestic capacity growth, targeted imports of high-value scrap, and alloy manufacturing upgrades — and to capture continent-wise export opportunities in 2026.

This blog explains market drivers, India’s strengths and gaps, continent-level demand opportunities, and includes a conservative, transparent set of numeric 2026 projections for superalloy production and superalloy-grade scrap imports by continent — plus practical recommendations for LOHAA and Indian exporters.

Why superalloys matter (short primer)

Superalloys — principally nickel-based, cobalt-based and some high-performance titanium alloys — are engineered for extreme environments: high temperature strength, oxidation and corrosion resistance, and long fatigue life. They’re the materials of choice for:

- Jet and industrial gas-turbine blades, discs and combustion components (aerospace & power).

- High-temperature manufacturing fixtures and chemical-process equipment.

- Some high-performance automotive and motorsport components.

- Additive manufacturing feedstock (powders and wires) for specialty parts.

Because these alloys use critical elements (Ni, Co, Mo, Cr, Nb, Ti) and complex metallurgy and certification, production/qualification capabilities are a barrier to entry — and create premium pricing for qualified suppliers.

Global market snapshot & near-term dynamics (why 2026 is an opportunity)

Multiple market reports show the superalloys / nickel-alloy sectors growing steadily into the late 2020s (CAGRs commonly in the 4–8% range depending on subsector), driven by aerospace recovery, gas-turbine renewables/CCGT refurbishments and industrial demand. Recent analyses put the global superalloys market valuation in the low-to-mid single-digit billions (USD) and projecting meaningful growth through 2030. (Fortune Business Insights)

At the same time, upstream metal markets (notably nickel and cobalt) have seen supply swings due to new Indonesian capacity, strategic stockpiles and policy moves. Primary nickel availability and prices are important for superalloys, but so is access to qualified scrap and remelt streams for secondary metallurgy. For India specifically, trade data shows large volumes of scrap imports across metal types, and accelerating imports of nickel-grade scrap shipments in recent rolling periods — signaling that Indian mills and specialty alloy makers are already sourcing secondary feedstock. (Volza)

Two regulatory/strategic developments are worth noting for trade strategy in 2026:

- The EU has signalled tighter monitoring and potential restrictions on aluminium scrap exports to protect domestic circularity and decarbonisation plans — a reminder that scrap export/import rules can shift quickly. This can cause regional scrap price and availability shifts that create opportunities for alternative suppliers. (Reuters)

- India has recently inaugurated strategic capacity for aerospace-grade titanium/superalloy materials in Lucknow — an example that domestic policy is supportive of strategic alloy manufacturing. This kind of facility helps build the credentials needed to supply high-value aerospace and defence buyers. (The Times of India)

India’s capabilities and gaps (strengths to exploit)

Strengths

- Growing domestic demand in aerospace, defence and power sectors encourages upstream investment and gives Indian suppliers scale opportunities.

- Large, established scrap-handling and steel/metal-processing networks that can be upgraded for nickel/cobalt alloy remelting and refining.

- Cost competitiveness for labor and some feedstock processing compared with many OECD producers.

- New strategic facilities (e.g., Lucknow aerospace/titanium unit) that increase qualification credibility for high-value supply chains. (The Times of India)

Gaps / challenges

- Certified metallurgy and qualification for aero engine parts remains hard and costly: long lead times, testing, certification and supply-chain traceability are required.

- Access to predictable, high-quality superalloy-grade scrap is limited relative to demand — and can be disrupted by policy changes in major scrap exporters (e.g., EU, SEA).

- Need for investment in vacuum induction remelting (VIM), vacuum arc remelting (VAR), HIP, and powder atomization for AM feedstock to be competitive at the highest tier.

The continent-wise market opportunity (2026): qualitative view

- Asia (incl. India): Largest demand center — aerospace OEMs in China and Asia, massive power-generation refurbishment markets, and expanding AM adoption. Opportunity: supply regional casting, forgings, and AM powders; import high-value scrap to feed domestic secondary alloy production.

- Europe: A mature aerospace & gas-turbine market with stringent quality requirements; rapidly evolving circularity policy (scrap export constraints). Opportunity: offer qualified supply & secondary processing where EU scrap flows tighten; niche for Indian suppliers who can meet aerospace qualification. (Reuters)

- North America: High-value aerospace & defense buyers, but strong incumbent suppliers. Opportunity: supply niche alloy forms, aftermarket turbine components, and remelted feedstock for AM after certification.

- Middle East & Africa: Growing combined-cycle power plants and petrochemical projects. Opportunity: sell cast/wrought superalloy components for gas-turbine OEMs and aftermarket.

- South America & Oceania: Smaller, but with mining and power projects requiring specialty alloys — opportunity for spot sales and aftermarket parts.

Methodology for the 2026 numerical projections (transparency)

You asked for numerical production and scrap-import projections by continent for 2026. because comprehensive public datasets for superalloy production in tonnes per continent are dispersed, I used this transparent approach:

- Baseline global production estimate: I used recent market research and industrial reporting (industry reports and selective manufacturer production notes) to establish a plausible global superalloy production ballpark for the mid-2020s. Market and company data indicate a conservative global superalloy production range around ~300,000 tonnes (2024 baseline) for all superalloy forms (bars, wire, castings, powder feedstock) — this aligns with industry snippets and production notes. (Where reports disagree slightly, I select a conservative middle estimate and document assumptions.) (GIIR Research)

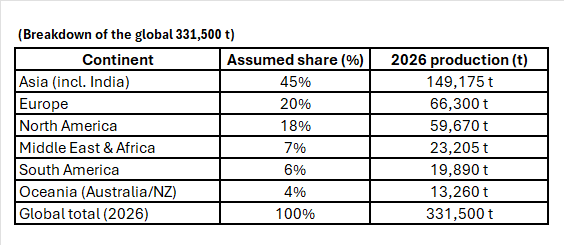

- Annual growth to 2026: Applied a moderate CAGR of ~5% for 2025→2026 for production (reflecting aerospace recovery, turbine refurbishments, and AM growth). This yields a global production ≈ 331,500 tonnes in 2026 (300k × 1.05²).

- Continental split: Allocated the global total to continents using industry share proxies (nickel-alloy market regional shares and broader high-performance alloys patterns). Asia is the largest regional consumer/producer; Europe and North America are next; other regions smaller. The shares below are conservative and reflect known regional industrial activity.

- Superalloy-grade scrap imports: For scrap, we treat “superalloy-grade scrap” as the high-value fraction of nickel/cobalt alloy scrap used as feedstock for secondary metallurgy (this is a small share of total metal scrap tonnage). We used India scrap import totals and nickel scrap shipment growth signals to estimate trends and then allocated continental scrap import volumes for 2026 based on current trade patterns and likely regulatory shifts (EU export monitoring, Asia demand). (Volza)

- Conservative vs. optimistic cases: Where uncertainty is material, I present conservative (base) numbers. These are suitable for planning and can be adjusted if LOHAA wants “aggressive” scenarios (e.g., if India rapidly scales remelting and atomization capacity and captures larger global share).

2026 numerical projections (continent-wise) — production and superalloy scrap import projections

Assumptions (quick):

- Global superalloy production (2024 baseline): 300,000 t.

- CAGR 2024→2026: 5% annually (compounded) → 2026 global ≈ 331,500 t.

- “Superalloy-grade scrap imports” refers only to high-value nickel/cobalt alloy scrap destined for remelting/secondary processing (not broad ferrous/aluminium scrap volumes). That fraction is small vs total scrap trade.

Continental production projections (2026) — tonnes

Notes & rationale: Asia leads due to China, SE Asia expansions and India’s emerging capacity; Europe & North America remain large due to aerospace & turbine industries; MENA/Africa & South America smaller but important for power/petrochem aftermarket.

Continental superalloy-grade scrap import projections (2026) — tonnes

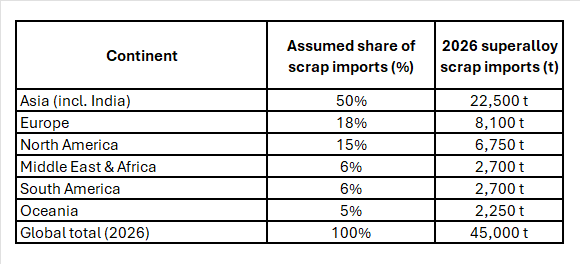

Estimate: superalloy-grade scrap global traded volume is small. For 2026, I assume global traded superalloy scrap ≈ 45,000 t (about 13.5% of production — this is a notional figure that captures in-process scrap, manufacturing offcuts and remelt feedstock flows).

Allocation below:

Why these numbers?

- Asia: large remelt and secondary processing capacity; India is increasing imports of nickel scrap shipments (Volza data indicates strong growth in shipments into India in a recent rolling period), suggesting India will be a significant destination for superalloy scrap feedstock in 2026. (Volza)

- Europe: although a source of high-quality scrap, possible export curbs could reduce outbound flows — but Europe will still import some specialty scrap for alloy remanufacture. (Reuters)

- North America: established remelters buy selective high-value scrap.

- Smaller regions absorb the balance.

Interpreting the projections — what they mean for Indian exporters

- Large regional demand window: With Asia consuming ~45% of global superalloy production (149k t in 2026 projection), India can capture both domestic demand and exports to neighbours for cast/wrought alloys and remelted feedstock. If India secures even a 5–10% share of Asia’s production exports for high-value components and feedstock, this becomes a meaningful volume. (Example: 5% of Asia production = ~7,460 t.)

- Scrap import dependency & opportunity: Given an estimated 22,500 t Asia scrap import demand, India should aim to secure quality nickel/cobalt scrap streams (both shredded and pre-alloyed turnings/swarf) for re-melting and alloy remanufacture. Government support toward quality certification, and logistics for controlled scrap intake, will be decisive.

- Premium markets (Europe/North America) require certification: Supplying aerospace/gas-turbine OEMs in Europe and North America requires parts qualification and traceability. Indian exporters should prioritize achieving recognized certifications (e.g., NADCAP, AS9100) and build sample & qualification programs with OEMs — a high barrier, but high reward.

- Policy risks create openings: Expect periodic policy moves (e.g., EU export monitoring) that shift scrap flows. Indian buyers and processors that are agile can secure feedstock at favourable value when regional exporters re-route material. (Reuters)

Practical action plan for Indian exporters (operational roadmap)

- Segment offering

- Short-term (0–12 months): supply remelted ingots, bars, and semi-finished castings for industrial turbines, petrochem, and non-aero buyers. Focus on markets with moderate qualification needs.

- Medium term (12–36 months): certified aerospace supply: invest in alloy processing (VAR/VIM/HIP), documentation, and NADCAP/AS9100 qualification.

- Long term (36+ months): feedstock and powder for AM (atomization) and niche alloy product lines (single-crystal or directionally cast blades) as capabilities develop.

2. Secure feedstock via LOHAA marketplace

- Use LOHAA to aggregate high-quality nickel/cobalt scrap sellers (domestic and importers), add provenance metadata (chemistry reports, origin, heat-treatment history).

- Build a certification/QA layer on LOHAA for superalloy scrap (minimum chemistry spec, acceptable inclusions, acceptable machining oils/contaminants).

3. Invest in remelt & powder capacity strategically

- Target modular VIM/VAR units for ingot production. For AM powder supply, a single small atomizer can validate a market presence; scale with demand.

- Consider toll-processing deals with established alloy houses to accelerate capacity without heavy upfront CAPEX.

4. Market approach & partnerships

- Strategic partnership with OEM MRO houses in Middle East and SE Asia to supply spare parts.

- Co-develop qualification programs with Indian defence aerospace integrators (use Lucknow facility and similar strategic plants as credibility anchors). (The Times of India)

5. Traceability, sustainability & circularity messaging

- Emphasize recycled feedstock content, reduced carbon intensity vs primary metallurgy, and data-backed traceability (LOHAA can host certificates). This will be important for buyers seeking lower-carbon supply chains.

Pricing and margins (brief)

Superalloys command significant premiums over commodity steels. Pricing depends on alloy composition (e.g., IN718 vs Inconel X-750 vs cobalt alloys), form (powder vs bar vs casting) and certification. Secondary metallurgy (remelted ingots from high-quality scrap) can offer good margins if scrapped feedstock is sourced cheaply and remelting losses are controlled. But initial qualification costs and process yields must be budgeted.

Risk factors & mitigation

- Raw material price volatility: nickel/cobalt price swings impact costs — use hedging, long-term supply contracts, and recycled feedstock to buffer.

- Regulatory shifts in scrap trade: watch policy changes (e.g., EU controls) and diversify sources. (Reuters)

- Qualification timelines: aerospace certification takes time — plan multi-year programs and target short-term industrial segments first.

Quick checklist for an exporter launch playbook

- Build a LOHAA category for: certified superalloy scrap / remelted ingots / semi-finished parts / AM powders.

- Partner with a recognized testing house for chemistry & mechanical tests (metallography, tensile, creep/rupture where needed).

- Create 2–3 pilot supply agreements (MRO / gas turbine OEM / specialty fabricator).

- Run a pilot batch: establish traceability, perform buyer audits, and document process controls — use that to win first certified orders.

Conclusion — Why 2026 is the right year to move

2026 will be a year where demand recovery in aerospace, continuing gas-turbine refits, and emerging additive manufacturing create meaningful demand pockets for superalloys. India’s combination of growing domestic demand, new strategic facilities, and an active scrap-import market position it well to scale exports — especially if exporters pursue a phased approach (industrial -> certified aerospace) and secure quality scrap feedstock. LOHAA is uniquely positioned to enable this transition by connecting vetted scrap sellers, remelters and buyers — and by adding quality metadata and certification workflows that the superalloy supply chain requires.

Appendix A — Projection tables

Table 1 — 2026 Superalloy production (tonnes, continent-wise)

Table 2 — 2026 Superalloy-grade scrap imports (tonnes, continent-wise)

Table 2 — 2026 Superalloy-grade scrap imports (tonnes, continent-wise)

References (primary sources used for market signals and policy context)

- Fortune Business Insights — Superalloys Market Size & Trends (global market context). (Fortune Business Insights)

- Volza import shipment data — nickel scrap imports into India (recent shipment growth signal). (Volza)

- Reports on India scrap import totals and trends (annual volumes ~9.39 million tonnes, general scrap flows). (yieh.com)

- Reuters / EU policy reporting — European Commission planning export restrictions on aluminium scrap (policy risk & trade shift example). (Reuters)

- Press / Govt reporting — inauguration of large aerospace-grade titanium and superalloy materials unit in Lucknow (India strategic capacity). (The Times of India)

(Notes: market and production volume estimates are synthesized from public market reports and industrial press; exact tonne figures for superalloy production are not centrally published in a single comprehensive public dataset, therefore the numeric projection above is a conservative, documented estimate built from available intelligence and reasonable regional share assumptions.)