India Secondary Steel Regional Demand and Production Forecast 2026

Introduction: The Engine of India's Infrastructure

The secondary steel sector is no longer just a "supplement" to India’s massive integrated steel plants; it is the vital backbone of the nation's construction and infrastructure narrative. Comprising over 1,000 units including Induction Furnaces (IF) and Electric Arc Furnaces (EAF), this sector accounts for approximately 40% of India’s total crude steel production.

As India marches toward its ambitious goal of 300 million tonnes (MT) of steel capacity by 2030, the secondary sector provides the agility, regional reach, and recycled material focus necessary to meet localized demand. This blog explores the sector’s performance in 2024 and 2025, provides a granular regional forecast for 2026, and analyses the shift toward technology-led profitability.

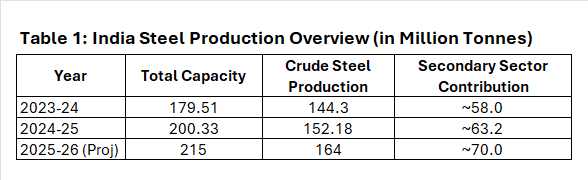

1. Production Performance: 2024 and 2025

The years 2024 and 2025 marked a period of resilience for Indian steel. Despite global headwinds, domestic production remained on an upward trajectory.

2024: A Year of Consolidation

In 2024, India solidified its position as the world's second-largest crude steel producer. Total crude steel production reached approximately 149.4 MT, a 6.2% growth over 2023. Within this, the secondary sector—predominantly MSMEs—contributed nearly 60 MT.

2025: Scaling New Heights

The fiscal year 2024-25 (ending March 2025) saw India hit a total capacity of 200.33 MT. Crude steel production for the period was recorded at 152.18 MT. The secondary sector's share remained stable at about 47% of total capacity, with a production output exceeding 63 MT.

Table 1: India Steel Production Overview (in Million Tonnes)

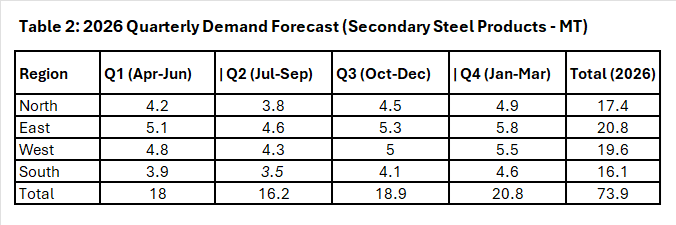

2. Regional Dynamics: Demand and 2026 Quarterly Forecast

Demand in India is largely driven by the National Infrastructure Pipeline (NIP) and the PM Gati Shakti program. However, this demand is not uniform across the country.

Regional Consumption Profiles

a) North India: Hub for automotive and light engineering; high demand for TMT bars and alloy steel.

b) East India: The "Steel Heart," dominated by raw material availability; major consumption in railway and heavy industrial projects.

c) West India: Port-led demand; high utilization in oil & gas, chemicals, and automotive sectors.

d) South India: Focus on renewable energy infrastructure (wind/solar) and electronics manufacturing.

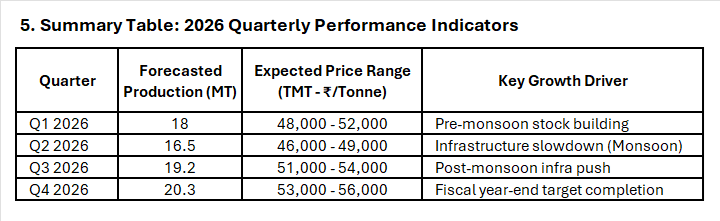

2026 Quarterly Forecast (Regional Wise)

The industry expects a steady 8-9% growth in demand for FY 2025-26. Below is a projection of regional demand (in MT) for the secondary steel sector:

Note: Q2 typically sees a dip due to the monsoon season slowing down construction activities.

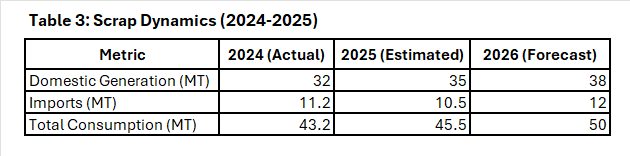

3. Scrap Generation and Import Trends

The secondary sector’s "fuel" is ferrous scrap and sponge iron. As the world moves toward "Green Steel," scrap has become a strategic commodity.

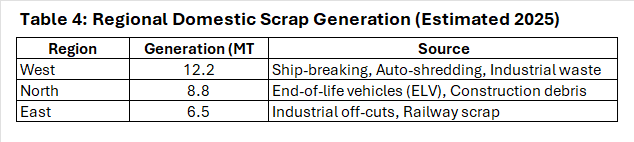

Regional Scrap Generation within India

Domestic scrap generation is rising but remains fragmented. Currently, India generates approximately 32-35 MT of scrap annually.

i) West India (35%): Leads generation due to ship-breaking (Alang) and the dense automotive belt in Maharashtra and Gujarat.

ii) North India (25%): Driven by industrial clusters in Haryana and Punjab and end-of-life vehicle (ELV) recycling.

iii) South India (22%): Contribution from the tech-industrial hubs and manufacturing zones.

iv) East India (18%): Mostly industrial scrap from existing heavy industries.

The Import Gap

Despite rising domestic collection, India remains a net importer of scrap to meet quality requirements and volume deficits. In 2025, imports hovered around 10-11 MT.

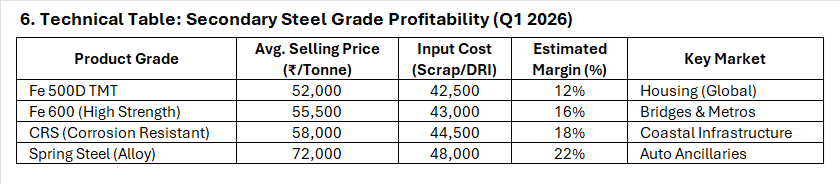

4. Profitability Analysis

Profitability in the secondary steel sector is highly sensitive to the Spread (the difference between scrap/sponge iron costs and finished steel prices).

Regional Profitability Trends (EBITDA Per Tonne)

• East: Highest profitability due to proximity to sponge iron plants and lower logistics costs for raw materials. Estimated EBITDA: Rs 4,500 – Rs 5,500/tonne.

• West: Stable margins due to high demand from the construction sector and easy access to imported scrap through ports. Estimated EBITDA: Rs 4,000 – Rs 4,800/tonne.

• North: Moderate profitability; often faces price competition from surplus supply from other regions. Estimated EBITDA: Rs3,500 – Rs4,200/tonne.

• South: High energy costs impact margins, but niche products (renewable structures) command a premium. Estimated EBITDA: Rs3,800 – Rs4,600/tonne.

Challenges to Profitability

i) Global Price Volatility: Surges in Chinese exports have historically suppressed Indian domestic prices.

ii) Raw Material Costs: Fluctuating coking coal prices impact sponge iron costs, which in turn affects the secondary sector.

iii) Operating Margins: ICRA projects margins to remain flat at approximately 12.5% for FY26 due to oversupply and pricing pressure.

5. Technology: The Path to Enhanced Productivity

To survive in a low-margin environment, secondary steel producers are rapidly adopting Fourth Industrial Revolution (Industry 4.0) technologies. The "secondary" label no longer implies "obsolete"; technological adoption is now the primary defence against rising raw material and energy costs.

5.1 Advanced Induction Furnace (IF) Upgrades

Modern Induction Furnaces are evolving from simple "melting pots" into precision-controlled instruments.

- IGBT Power Supplies: Transitioning from traditional thyristor-based systems to Insulated Gate Bipolar Transistor (IGBT) technology. This improves electrical efficiency by up to 10% and provides a better power factor.

- Bottom Stirring Technology: By injecting inert gases (like Argon) from the bottom of the furnace, units ensure a more homogeneous melt. This reduces "slag trapping" and improves chemical consistency, crucial for high-grade TMT production.

5.2 The "Green" Transformation & Energy Efficiency

Decarbonization is moving from a regulatory burden to a cost-saving strategy.

- Hot Charging (DRI): Instead of cooling Sponge Iron (DRI) and then re-heating it, modern plants use "Hot Charging." DRI is fed directly into the furnace at temperatures exceeding 600°C, saving significant energy (measured in $kWh/tonne$) and reducing melting time.

- Energy Recovery Systems: Capturing waste heat from furnace exhaust to pre-heat scrap or generate captive power.

- Renewable Hybridization: Secondary units, particularly in Rajasthan and Karnataka, are signing Open Access Power Purchase Agreements (PPAs) for solar and wind energy, cutting electricity costs by Rs1.5–Rs2 per unit.

5.3 Digital Twins and AI-Driven Optimization

The integration of IT and OT (Operational Technology) is maximizing yields:

- AI-Optimized Scrap Mix: Machine learning algorithms help plant managers determine the most cost-effective ratio of Scrap vs. Sponge Iron vs. Pig Iron based on real-time market prices while maintaining the desired metallurgical properties.

- Predictive Maintenance: AI sensors on furnace linings monitor thermal profiles to predict a "breakout" before it happens, preventing catastrophic failures and unscheduled downtime.

- Automated Rolling Mills: Implementation of automated TMT quenching processes (such as Thermex or Tempcore) ensures that the cooling rate is mathematically precise, resulting in consistent ductile properties across every batch.

6. Deep Dive: Regional Profitability and Cost Structures

Profitability in the secondary steel sector is not uniform across India; it is a delicate balance of raw material proximity, energy costs, and logistics efficiency.

6.1 East India: The Efficiency Leader

• Operational Context: States like Odisha, Jharkhand, and West Bengal are the "Iron Belt." Secondary units here often use a high ratio of Direct Reduced Iron (DRI/Sponge Iron) due to local availability.

• Profitability Drivers: The EBITDA per tonne is typically Rs 800–Rs 1,200 higher than the national average. This is primarily due to:

o Proximity to Mines: Drastic reduction in "Last Mile" logistics for iron ore and coal.

o Sponge Iron Surplus: Secondary units can negotiate better rates with local DRI manufacturers.

• Marginal Pressure: While realisations are high, the region faces "Supply Gut" during monsoon seasons when local construction slows down, forcing units to export to other states, eating into margins through freight.

6.2 West India: The Logistics Hub

• Operational Context: Centered around Maharashtra (Jalna, Mumbai) and Gujarat. These units are heavily reliant on Ferrous Scrap.

• Profitability Drivers: * Import Parity: Proximity to ports (Kandla, Nhava Sheva) allows units to leverage global scrap price drops quickly.

o Market Premium: High demand from the automotive sector (Pune/Ahmedabad) allows for higher-grade alloy steel production, which carries better margins than standard TMT.

• Challenges: High electricity tariffs in Maharashtra (often Rs 7.5–Rs 9 per unit) are a significant drag on profitability for Induction Furnaces.

6.3 North India: The Price Benchmark

• Operational Context: Mandi Gobindgarh (Punjab) and NCR clusters. This region sets the national benchmark for HMS (Heavy Melting Scrap) prices.

• Profitability Drivers: The North is the most organized in terms of scrap collection and trading.

• Challenges: Severe overcapacity leads to aggressive price wars, often keeping EBITDA margins thin averaging around 9-11%.

6.4 South India: The Specialized Market

• Operational Context: Clusters in Karnataka, Tamil Nadu, and Telangana.

• Profitability Drivers: Demand from the renewable energy sector (wind towers/solar frames) and white goods.

• Challenges: Water scarcity in certain pockets and higher transportation costs for coal/iron ore from the East.

7. Scrap Management: Domestic Generation vs. Imports

As India pushes for a "Circular Economy," the role of the Scrap Recycling Policy 2019 and the Vehicle Scrapping Policy has become central.

7.1 Domestic Generation Trends (By Region)

Domestic scrap generation is transitioning from the "Informal" to the "Formal" sector.

7.2 Import Dynamics: 2024-2026

While domestic collection is rising, India remains the world's leading importer of ferrous scrap.

i) 2024 Trends: Imports grew as global prices softened. Major origins: USA, EU, and UAE.

ii) 2025 Shift: A slight dip in imports as domestic DRI (Sponge Iron) became more cost-effective due to local iron ore price stability.

iii) 2026 Forecast: Imports are expected to stabilize at 12 MT as the sector adopts more Electric Arc Furnaces (EAF) which require higher-purity scrap to produce specialty steels.

8. Regional Case Study: The Transformation of North India’s Steel Clusters

The North Indian steel belt, historically centered in Mandi Gobindgarh (Punjab) and Hisar (Haryana), is undergoing a painful but necessary structural transformation in 2026.

The "Steel Town" Crisis and Pivot

Traditionally, Mandi Gobindgarh was known as the "Steel Town of India," dominated by thousands of small-scale re-rolling mills. However, 2024-2025 saw a wave of closures due to high power costs and competition from larger secondary plants in the West and East.

i) The 2026 Shift: Surviving units in the North are pivoting from basic TMT bars to Specialty Alloy Steels. By integrating with the local automotive supply chain (Maruti Suzuki, Hero MotoCorp), these units are achieving margins that are 15-20% higher than standard construction steel.

ii) Energy Solutions: To counter Punjab’s high industrial power tariffs, a consortium of 50 secondary units recently invested in a Common Solar Park, a model now being replicated in the South.

9. Raw Material Warfare: Sponge Iron vs. Ferrous Scrap

A critical technical shift in 2025-2026 is the changing "Charge Mix" in Indian Induction Furnaces (IF).

The Rise of the DRI-IF Route

While the global secondary sector is "Scrap-EAF" based, India has pioneered the DRI-IF (Direct Reduced Iron - Induction Furnace) route.

i) Production Surge: India’s sponge iron production surged by 44% between 2021 and 2024, hitting 55 MT in 2025.

ii) Substitution Logic: In 2026, many mills have reduced scrap usage to just 15-20% of their melt, using 80% DRI. Why? Because sponge iron offers a predictable chemical composition, whereas local scrap often contains "tramp elements" (like Copper or Tin) that weaken the final steel.

iii) Price Parity: As of Q1 2026, domestic sponge iron is trading at a significant discount compared to imported shredded scrap, giving a Rs1,500/tonne cost advantage to mills in the East and Central India.

10. Policy Impact: The Union Budget 2026 and Secondary Steel

The Union Budget 2026, presented in February, has introduced three "Game Changers" for the secondary sector:

i) Infrastructure Risk Guarantee Fund: A Rs 5,000 crore fund to backstop payment delays in infrastructure projects. This is vital for secondary producers who often face 90–120 day credit cycles when supplying to government contractors.

ii) Mission Coking Coal Extension: While secondary mills use less coking coal than Blast Furnaces, the government’s push to hit 140 MT domestic coking coal by 2030 is stabilizing the overall energy market, preventing "Sponge Iron price spikes."

ii) The "Shanti" Nuclear Energy Bill: This allows private secondary steel clusters to invest in Small Modular Reactors (SMRs) for captive power. This is revolutionary for energy-intensive Induction Furnaces, potentially lowering power costs to under ?4 per unit.

11. The "Green Steel" Challenge for MSMEs

By 2026, the Carbon Border Adjustment Mechanism (CBAM) in Europe is no longer a distant threat; it is a reality. Secondary producers are responding with:

i) Green Hydrogen Injection: Trials in Odisha have shown that injecting 10% Hydrogen into the DRI process can reduce $CO_{2}$ emissions by 15%.

ii) Formalizing Scrap: The government’s authorization of 183 vehicle scrapping facilities (as of late 2025) has finally provided a "clean" stream of high-quality automotive scrap, allowing secondary mills to claim a "Recycled Content" certification, which is essential for exports.

12. Conclusion: A Strategic Outlook

The Indian secondary steel sector is entering a "Golden Decade." With demand set to grow by 8% in 2026, the sector's agility will be its greatest asset. However, the transition from a "quantity-focused" to a "quality and technology-focused" model is no longer optional.

Producers who invest in organized scrap procurement, energy-efficient furnaces, and regional market specialization will lead the profitability charts. As the government tightens environmental norms, "Green Secondary Steel" will likely become the premium product of the future.

By using digital trade platforms like LOHAA Mobile application, you can reach global buyers, source quality material, and strengthen long-term partnerships.

Download the LOHAA Mobile application today and connect with verified scrap suppliers and manufacturers.

References & Data Sources

1. Ministry of Steel, Govt of India: Annual Report 2024-25 and Monthly Economic Reports (July-Sept 2025).

2. Joint Plant Committee (JPC): Production and Consumption Statistics for Finished Steel.

3. ICRA Limited: Steel Industry Trends & Outlook (May & Dec 2025 reports).

4. World Steel Association (WSA): Short Range Outlook 2025-2026.

5. BigMint/Metal Expert: Ferrous Scrap Import and Domestic Generation Data.

6. JMK Research: Green Power Procurement in the Secondary Steel Sector.

7. Joint Plant Committee (JPC): Quarterly Steel Performance Data (2024-25).

8. MRAI (Material Recycling Association of India): Ferrous Scrap Generation Report 2024.

9. SteelMint: Price Index and Profitability Analysis (Secondary Steel Sector).

10. Ministry of New & Renewable Energy (MNRE): Industrial Decarbonization Roadmap.

11. CRISIL/ICRA: Steel Sector Credit Outlook 2026.

(Notes: market and production volume estimates are synthesized from public market reports and industrial press; exact tonne figures for steel production are not centrally published in a single comprehensive public dataset, therefore the numeric projection above is a conservative, documented estimate built from available intelligence and reasonable regional share assumptions.)